Zero to Stockpile – How to Do a Budget –

Today we are going to talk about the B word. The word that no one wants to talk about but, in all honesty, you have to. BUDGET!

Why You Need a Budget

First, let me just say, this isn’t going to be a big, how to set up your budget post. If you are looking to dig more into a full budget then be sure to take a look at my post How to Set Up a Budget and Stick to It. I will tell you, right here and now, you absolutely need a budget.

It doesn’t matter if you make $15,000 a year or if you make $1.5 million dollars a year. Everyone needs one. As my favorite budget guru, Dave Ramsey says “A budget is telling your money where to go instead of wondering where it went.” If you just spend, how will you know how much you really can spend. You won’t! And, nine times out of ten, you’ll overspend and, like Dave says, you’ll wonder where it went.

But, let’s focus here on your grocery budget. What is your grocery budget right now? If you don’t have one, chances are you don’t know how much you are spending on your groceries each week. If that is the case, you need to sit yourself down and figure out how much you have spent on your groceries over the past year. Dig through credit card, debit card statements and add it all up. Then divide that by 52 to determine how much you are spending each week.

Then from there, you need to determine if that amount is good for you and your family. If it’s not, you need to come up with a more realistic grocery budget for yourself.

If you were averaging $250 a week throughout the past year but you truly can only afford $150, then some changes to your shopping need to be made. And good thing you are here, because that is exactly what we are all about.

My Grocery Budget

As some of you already know, before I became a “smart shopper”, I spent about $300 a week on my groceries for a family of 5. After a bout of unemployment and major debt, I was forced to put my family on a super strict budget of just $50 a week. However, sticking to that budget didn’t happen overnight.

I had no stockpile so the store was dictating to me how much I was spending on the items that were important to my family. But I had a goal of hitting that $50 mark. And, sure enough, after about 4 weeks of couponing and stocking up on products that were on sale and using coupons, I started to really see my savings dip each week. By the time I hit around 12 weeks or 3 months, I reached my goal of only spending $50 each week.

As we got out of unemployment and worked super hard to pay off our debt, I was finally able to increase my budget to $75 a week. Which allowed some wiggle room for some of things we couldn’t afford previously.

Now that my stockpile is gone, and I’ve lost my control of how much I want to spend on each item we use, I am forced to increase my weekly budget to $200 a week with the goal of getting back down to $75 at around 3 months (hopefully sooner).

Your Budget & Goal

Now it’s your turn. As I mentioned above, set a goal for yourself to meet. Know that you won’t be there in the first week, but you will be working towards it as your stockpile grows.

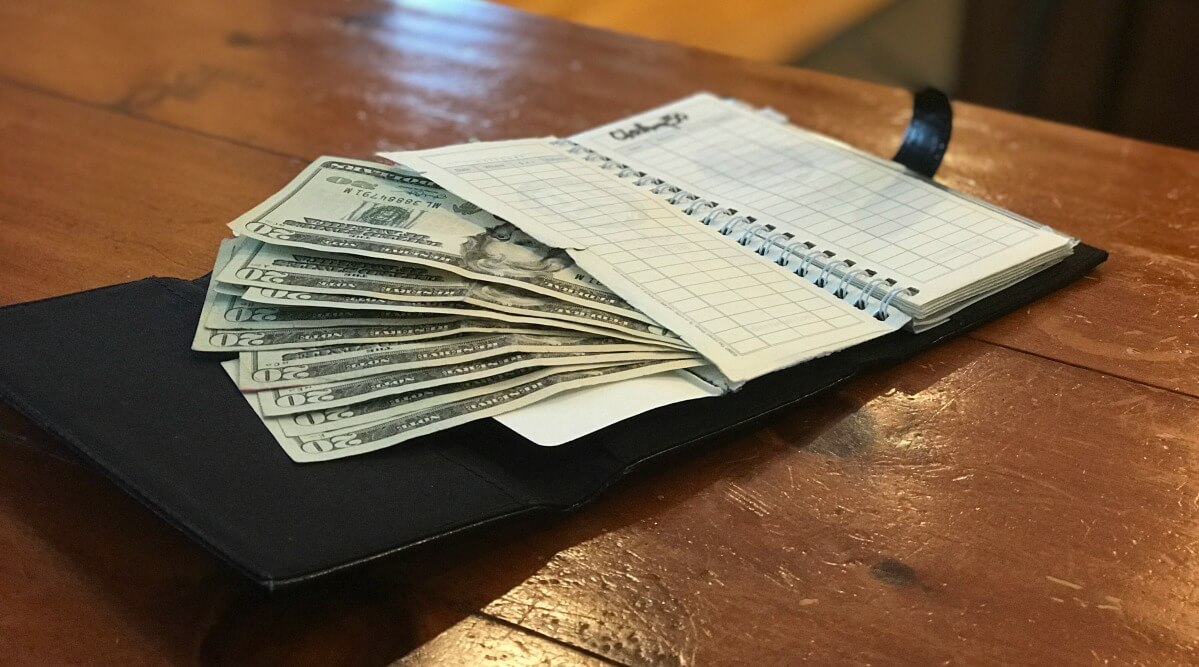

Cash, Credit Card or Debit

Let’s touch briefly on this hot topic. And I say hot topic because people have very strong opinions on using cash only, credit cards or your debit card.

Me personally, I’m a cash only girl. We have cash envelopes that hold several of our expenses including:

- Groceries

- Gas

- Clothes

- Haircuts

- Dry Cleaning

- Blow Money for my husband

- Blow Money for myself

I can NOT use credit cards. As a matter of fact, we haven’t had a credit card in over ten years we don’t miss them at all.

But, I get that some of you are good with credit cards and like the points you can score with them. More power to you but that is just not me. If you’ve been in credit card debt, you know exactly what I’m talking about. The points are just not worth it to me.

You need a system though. If it’s cash envelopes, great! Make it a plan to put your budget money in that envelope each week. If it’s credit or debit cards, figure out a way to watch your savings. Maybe it’s through a program you own or use or maybe it’s just tracking it in your planner. Whatever it is, you need a system to track it.

When the money is gone for the week, it’s gone. You are done shopping.

Using the cash envelopes for me, makes it easy because if there is no more cash, I have nothing to spend. If I didn’t spend as much the week or weeks prior, then I can use that cash to stock up on a great sale on meat.

However you decide to do it, sit down, today, figure out your budget, your goal of where you want your budget to be at the 3 month mark and how you will track your spending.

Things to Keep In Mind:

- If you are using the envelope system, you don’t need anything fancy. Just simple envelopes will do. We use this budget envelope system

- The budget you need will vary for your family based on the size of your family. My family, right now, consists of 3 adults which is equivalent to an average family of 4 (2 adults & 2 kids).

So that’s your third assignment. Now, go get that budget ready because if you don’t have a budget, you won’t know where your money is being spent!

Tips to Follow My Journey

- Follow me on my Instagram account where I post, via my IG Stories, all my day to day!

- Join our Zero to Stockpile Facebook Group.

Even More Ways to Save